VisiFI Tune-In Newsletter

Fall 2024

Welcome to the VisiFI Tune In Newsletter - Fall Edition.

VisiFI is committed to empowering financial institutions with innovative, cutting-edge technology solutions that accelerate growth and personalized service. Our Tune In newsletter is designed to keep the market informed, inspired, and equipped with our latest updates —from product enhancements, market trends, or strategic insights from customers and industry leaders.

Tune in to discover how VisiFI continues to evolve and unlock value for our customers. We hope you enjoy this edition and gain insider knowledge on who we are, what we are about, and where we are going. We look forward to your feedback!

Our Company Story

We are an ecosystem of companies that help community financial institutions seize the growth opportunities offered by the technological evolution.

VisiFI is a digital-first developer and integrator for community financial institutions. We provide flexible, open, and modular banking solutions built to accelerate customer growth and personalized services. From core to digital banking, account opening, digital lending, and everything in-between, we create connected and secure experiences protected by industry best practices in data and systems security.

Dedagroup

VisiFI is part of Dedagroup’s (deda) US Solutions Center. Deda is a privately-owned global technology group specializing in strategic digital services and solutions, focusing on multiple industries and markets, including financial services, digital transformation, cybersecurity, and artificial intelligence. We blend industry-specific know-how and technology with our development and integration capabilities to help our customers drive growth in loans, membership, and business relationships.

As a privately owned company, we prioritize gaining market insights to identify strategic opportunities. Our resource allocation is geared towards customer growth solutions, with a focus on understanding customer best practices and finding strategic partners who can be integrated into our platform. We believe in collaboration and fostering strong relationships while staying true to our mission-driven values. Our dedication to excellence and innovation has earned us industry awards for our commitment to delivering high-quality services and digital solutions.

Revenue

$27M Consolidated FY23

Employees

85 North America

Customers

100+ Credit Unions and Banks

Sweet Spot

Digital Banking $1B and Below Core $500M and Below

R&D

12-15% Annually

$370M

Consolidated revenues in 2023

4,000+

Customers

3,000

Employees globally across 49 offices

160+

Credit Unions

Digital First Solutions

Rooted in behavioral science, to create end-to-end solutions that enhance and grow account holder engagement. Our approach is driven by customer collaboration and supported by an innovative, global ecosystem.

Digital Suite

- Digital Banking Suite

- Digital Account Opening

- Digital Lending

- Money Movement

- Card Management

- Wires & International Remittances

- Funds Transfer (ACH) Person-to-

- Person Payments

- Chatbots

- Robust Integrations

Core Banking System

- Real-Time System Access

- Integrated Member Services

- End-to-End Teller Platform

- Advanced Card Management

- Integrated Accounting Suite

- Comprehensive Collections

- Advanced Back Office (5300)

- Mortgage Servicing

- Strategic Integrations

- Doc Management System

Lending Suite

- Multi-Loan Types

- Third-party Form Provider,

- Municipal Organizations or CU

- Created Documents

- Central Storage for Easy Loan

- Application Access and Audit.

- JD POWER Integration For

- Vehicle Values Easy Task

- Management Checklists

- One Stop Location For All Things LOS

Deda Ecosystem by the Numbers

We're part of a larger mission-minded community of dedicated people...

- deda.digital - 73% lift for credit unions by designing an award-winning innovative Digital Banking Application

- Dedagroup Mexico - 85% lift after expanding Card Management app and expanding real-time API calls with Card Processors

- Dedagroup Italy - 200% increase in new accounts and 30% increase in loans after delivering Digital Account Opening and Digital Lending Applications

- Dedagroup Italy & deda.cloud - Combats over 110,000 cyber attacks each month with 24/7/365 security monitoring & technology

- Deda Expertise - Assisted in implementing SalesForce.com processes to streamline projects with a focus on Customer Excellence

CEO Letter

Vision and Strategic Direction

I am pleased to share our inaugural “Tune In” Newsletter with you. We aim to provide quarterly insight into our business, product evolution, and where we are heading. Our vision and strategic direction are shaped by the market challenges our customers face. In 2023, several factors impacted financial institutions, including economic shifts, market dynamics, consolidations, and increasing threats to cybersecurity. Through these challenges, we also recognize the unique opportunities ahead for our customers and the communities they serve. We remain committed to better serving our customers, enhancing technology solutions to support growth, driving operational efficiencies, and improving the user experience.

Strategic Focus and Commitment

Dedagroup’s commitment to international expansion and investment in the US through acquisitions, integrations and strategic partnerships will further support growth and transformation within the financial services market. Dedagroup’s focus on key areas within this market, such as AI, Business Intelligence, Cloud, IT Services, Cybersecurity, and Digital Transformation, empowers VisiFI to deliver cutting-edge software and services. We remain dedicated to strengthening our competency and capacity to provide exceptional service and support to our valued customers.

Investments and Advancements

Throughout the year, we made significant investments and progress to enhance our technology solutions, focusing on both core and digital while reinforcing our infrastructure and security measures. Here are some of these notable achievements:

- Upgraded our proprietary core system, i-POWER®, by adding over 365 critical features.

- Streamlined user experiences for i-POWER® (UX/UI) and core modules including Collections, OFAC FinCEN, Document Management System, 5300, and Lending Center

- Added 164 key features to digital solutions, earning recognition as one of the Best Digital Lending Solutions by Callahan

- Invested in recruitment efforts to build our team, bringing in more innovative ideas, expertise, and collaboration to support our strategies

- Forged partnerships with industry leaders like Plaid, Pidgin, ChexSystems, and SavvyMoney and will continue our cooperative ecosystem approach to Build, Buy, Partner while exploring partnerships and acquisitions to help us achieve our goals

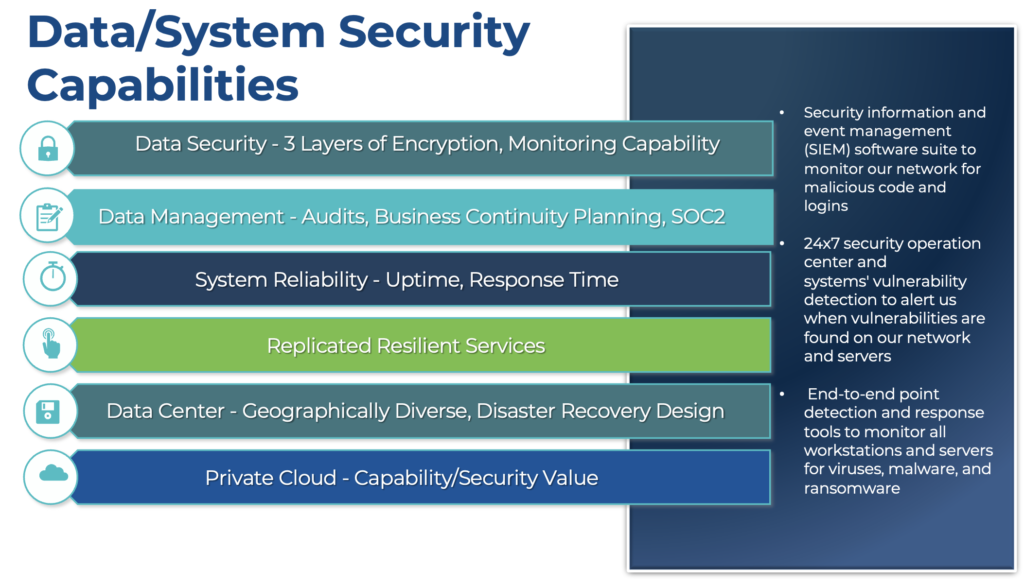

- Implemented additional security measures to safeguard customer data, including a Security Information and Event Management (SIEM) software suite.

- Established 24×7 vulnerability detection programs

- Deployed end-to-end point detection and response tools for virus, malware, and ransomware monitoring

- Will end the year with 13 conversions with 7 more scheduled in 2025+

Accelerating Growth and Personalized Service

Our vision and efforts align around three key pillars: strategy, sales & service, and customer growth. We’re setting new standards for growth, making incremental changes across the entire enterprise. We position ourselves as a “Customer-Focused” Strategic Developer and Integrator, driving positive change through customer-centric practices that support growth, transformation and value creation. Our team also prioritizes employee and member experience while adhering to industry standards that ensure data and system integrity.

2025 is shaping up to be an even stronger year with more positive growth. We are winning deals in both core and digital, growing our team, and investing in enhancing our sales & service model.

We are excited about our future and expansion plans. I welcome your feedback and look forward to working with you and your team.

Best Regards,

Robin Kolvek

Chief Executive Officer,

VisiFI

Market Insights

VisiFI's business is centered on strategic initiatives that accelerate customer growth and deliver personalized service.

Our customer’s voice, vision and values are the center for roadmap initiatives, and by offering participation in monthly innovation labs, we prioritize their input in shaping future developments. Our commitment extends to fostering collaboration through the Annual Roundtable and Client Conferences, where innovative ideas are shared and connections are strengthened. Each financial institution is supported by a dedicated Account Manager and Strategic Relationship Representative, ensuring personalized attention. We also conduct annual system tune ups to keep customers’ operations optimized.

Additionally, we prioritize community collaboration through:

- Continued partnerships with Curql, Inclusive, AACUC, and NLCUP

- Leading discussions and credit union workshops at Inclusiv, NACUSO, and NCUA in 2024

- Sharing knowledge with monthly VisiFI T.I.P.P.’s podcasts highlighting successful credit union initiatives, industry experts on market and data trends, and more

- CUSO Due Diligence and Pricing Models – our month Digital Innovation Labs help our customers vet thrid-party vendors and negotiate CUSO pricing models with vendors with no term

- Quarterly Spark Session with credit unions to discuss hot topics

Monthly Podcast

Case Studies, White Papers

Product Roadmaps

Monthly Innovation Labs

Quarterly Spark Sessions

Implement, Measure & Modify

OUR SOLUTIONS

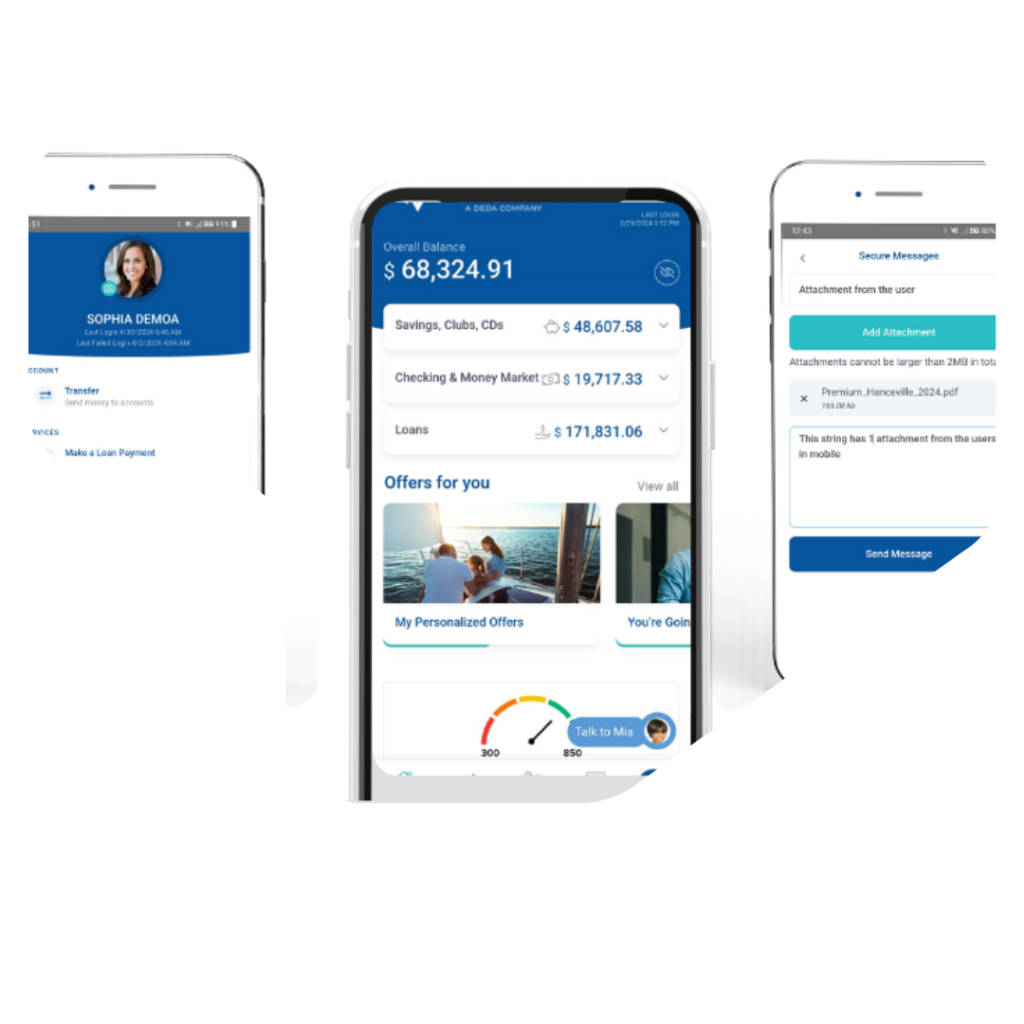

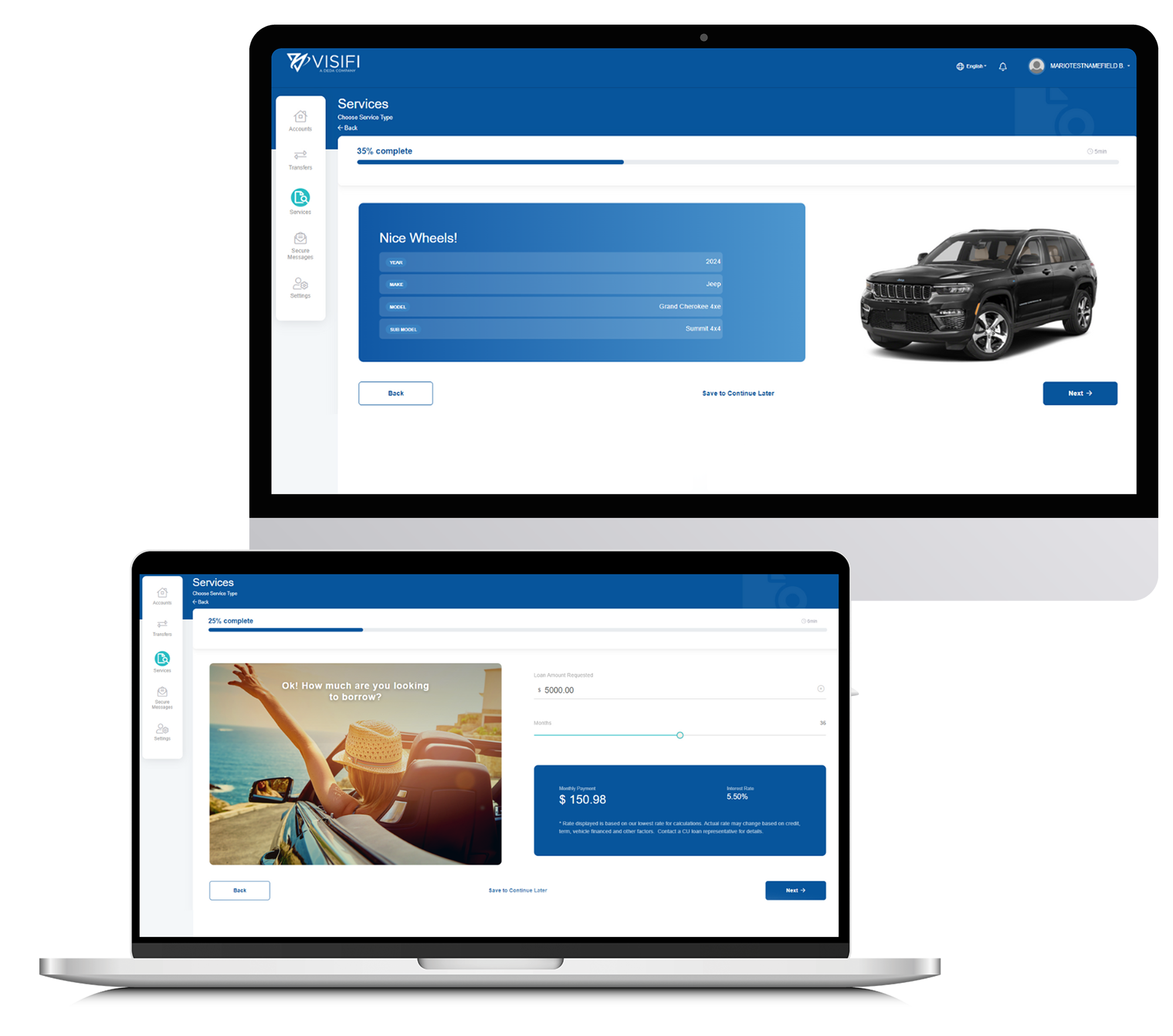

The VisiFI Digital Banking Experience

VisiFI Digital Banking is designed to work with our proprietary core or a wide range of other core systems, making it highly flexible and customizable to your needs. Looking to supercharge your account growth and deposits? Our integrated 3-minute digital account opening, funding, and digital lending solutions accelerate revenue, account approvals, and data duplications in no time.

“We have noticed a significant improvement in the member experience, and increased usage of our mobile app and online banking through VisiFI. Our card management functionality has also seen a surge in usage.”

- Nadine Hohnke, AVP Member Experience and Product Development, Public Service Credit Union

Features

Advanced Design/Workflow Automations

Bill Pay

Conversational AI Chatbots 24/7

Customized Joint Signers Access

Marketing Communications and Offers

Financial Wellness Tools

Pay Loans or Make Deposits at other FI’s

Instant Real-Time Payments

International Payments

Person-to-Person Payments

Real-Time Remote Deposit Capture

Secure Messaging

Advanced Card Management

Say Hello to Game Changing Digital

True End-to-End Functionality

Advanced Design, Customizable Workflow Behavioral Science Ensures Engaging Experiences Data Insights. Reporting – Marketing Automation New Accounts/Relationships – Offer, Apply, Transfer Marketing Offers/Campaigns Credit Monitoring & Financial Wellness Admin/Operation Tools Advanced Admin Console Account Management Tools Card Management Bill Pay

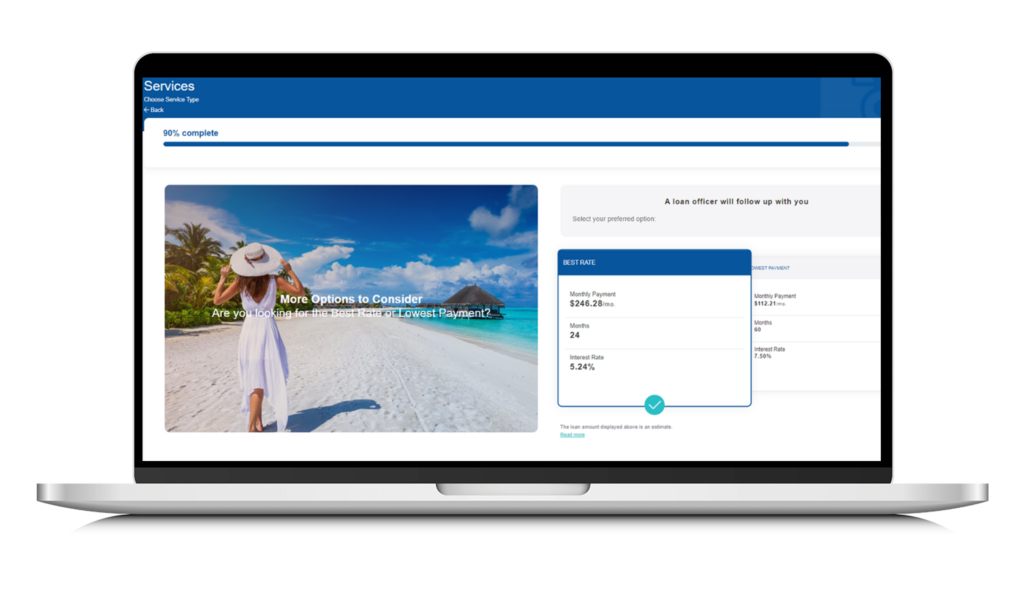

Digital Account Opening solution has a balance of security (secure, risk averse) and user experience (agile, low-friction and engaging user). Super charge account growth with our robust 3-minute Digital Account Opening application that offers many options and customizations.

Real Time Payments/Money Movement International Payments Pay Loans or Make Payments or Deposits at Other FI’s Person-to-Person Payments Real-Time Remote Deposit Capture Personal Financial Management Secure Messaging Chatbots 24/7/356 Customized Account Access ID auto-fill application and video selfie (ICYC)

200%

increase in membership applications within 10 months

74%

lift in member usage after 12 months

30%

more loans in 60 days

Digital Highlights

In the last year we have added 165+ new key features to our digital solutions, and earned recognition as one of the Best Digital Lending Solutions by Callahan.

Digital Banking Admin

Account Profile (90% traffic) Incorporated Behavioral Science to increase efficiency and enhance user experience.

Travel Alerts

Expanded Card Mgmt- Provided Self- Service Option & Revenue

Transfers

Improved Member Experience & Workflow Automation.

Advanced Search Capability

Transaction Level Detail

In-House CC's

Embed within Card Mgmt App

Instant RT Payments "Receive"

Ability to Receive Payments Instantly

DAO - Default Branch

Reduce Abandonment Rate

VisiFI customers have seen an average lift of 30% within 30 Days, 45% lift within 6 Months and 73% lift after 1 year of implementing the Digital Banking Solution.

– Jami Jennings

Core Banking Elevated

“When transitioning to i-POWER®, we valued its capacity to swiftly and seamlessly integrate new products. The system is highly configurable and guides us through each step, guaranteeing optimal outcomes for

- Julie Nelson from OPPDEFCU

Product Evolution - Exceptional User Experience

CORE HIGHLIGHTS

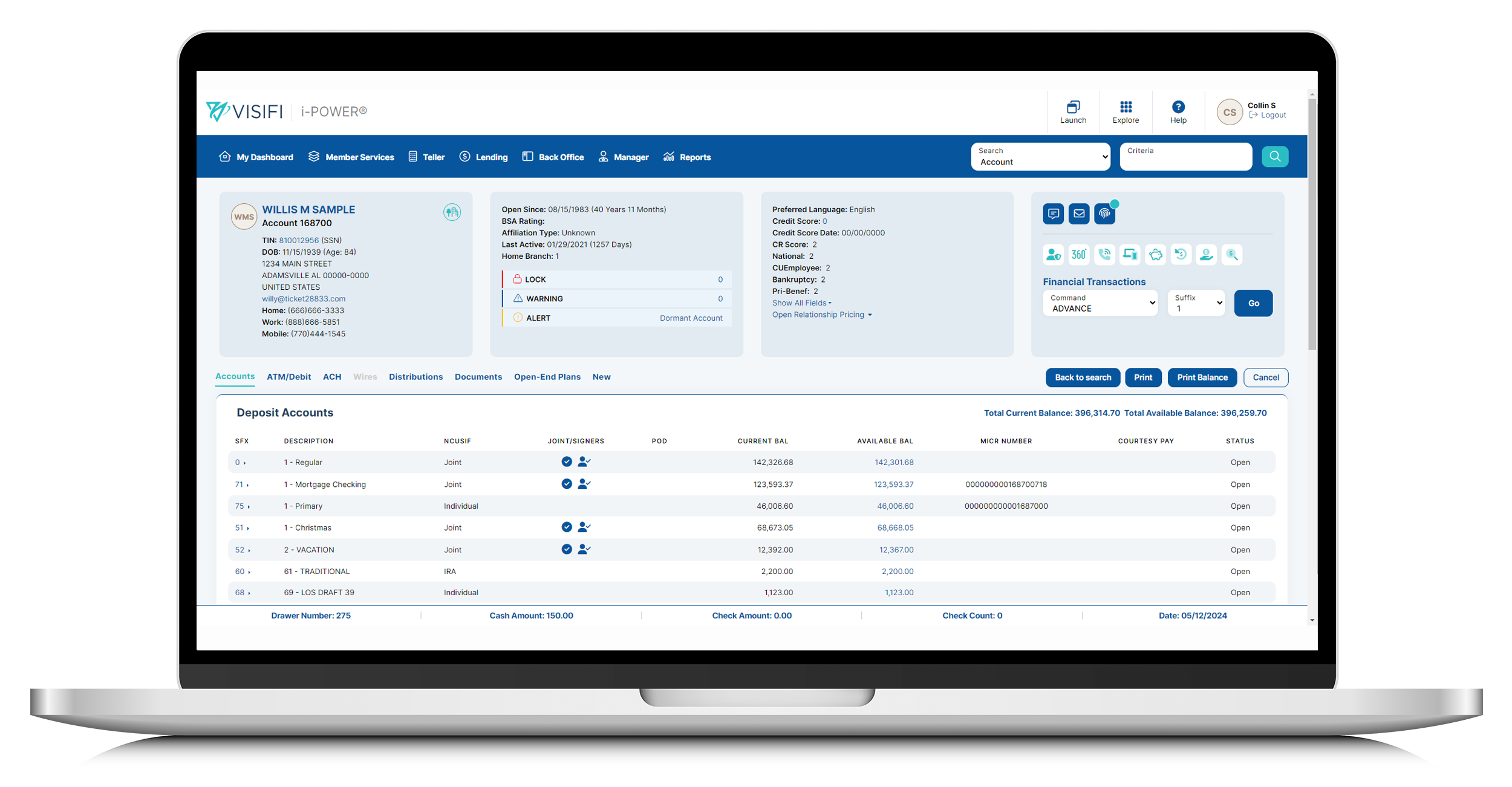

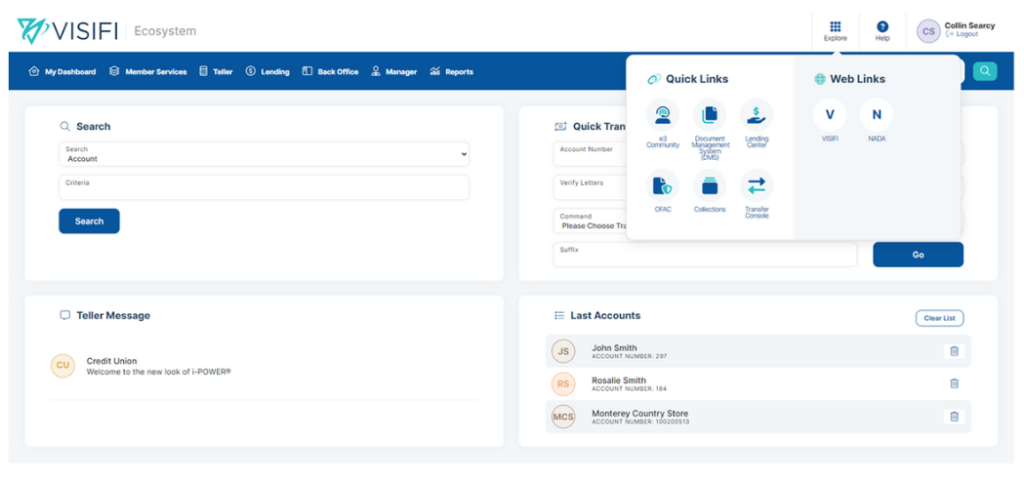

New Design of i-POWER® is LIVE Across All Customers!

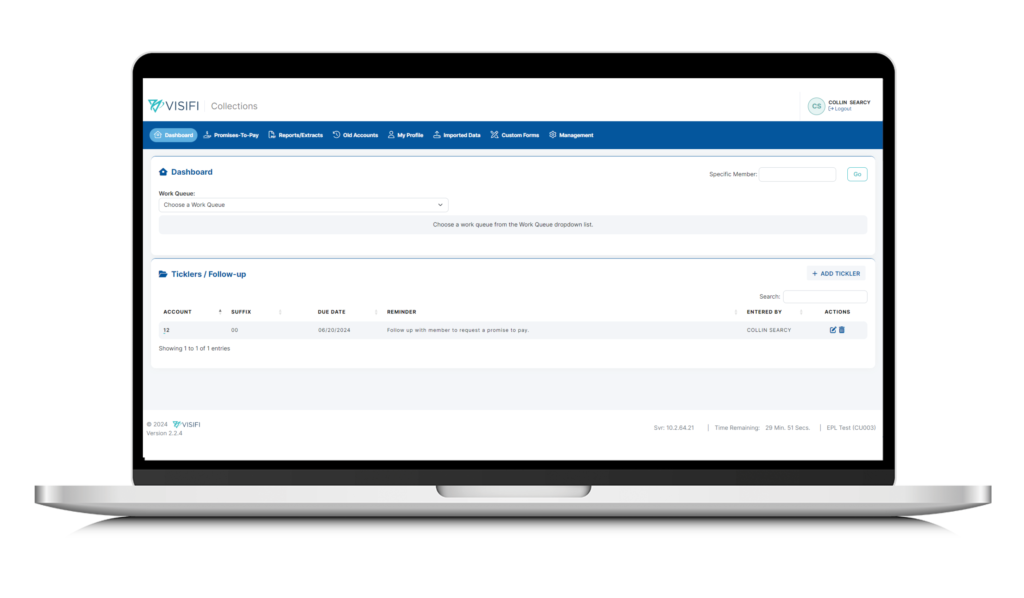

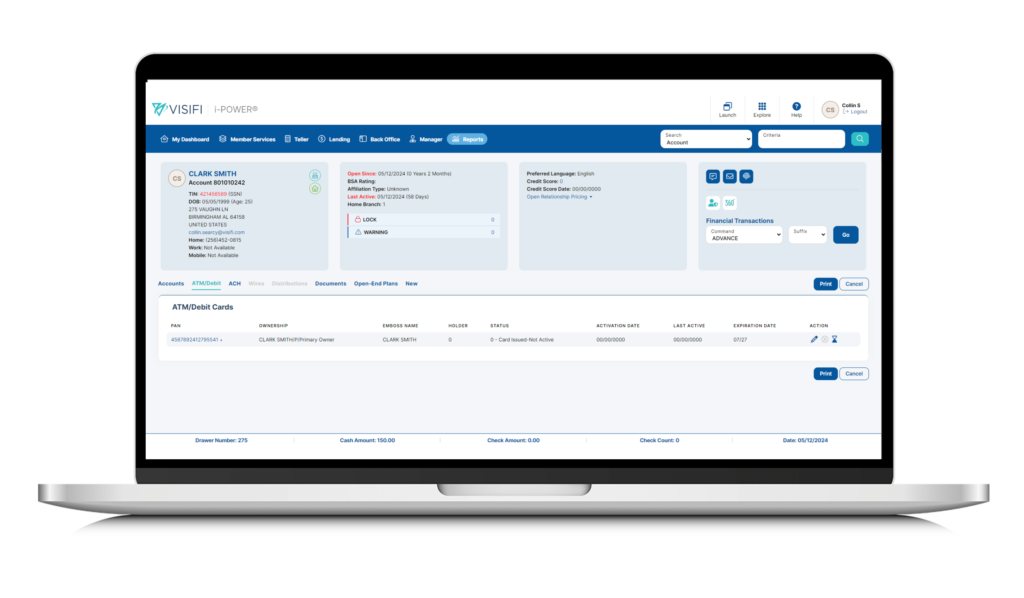

Comprehensive Financial Ecosystem

With easy-to use features, our core banking system simplifies complex operations, reduces clicks and automates time-consuming routine tasks, while enhancing and personalizing member experiences. Many customers converting from other systems have reported significant improvements in operations, including real-time visibility/access, optimized efficiency, automation, and enhanced services.

Flexible and Scalable

Highly adaptable solution that can grow with your institution. Whether you’re a small credit union or a community bank, it can be tailored to meet your specific needs.

Seamless Integration

Our core banking solution seamlessly integrates with your existing systems and applications, minimizing disruptions and simplifying the implementation process

- Updated login and landing screens with a cleaner look and new feel

- Main navigation enhancements include quick links for easy access to modules – no more scrolling and missing your desired selection

- Updated and organized member profile to help you quickly and effortlessly search for specific transactions, account details, and more

- Quick access to most commonly used areas such as Menu, Alerts/Warnings/Suffix Menu

Key Features

- Integrated Collections and Payments System

- Behavioral Science-Backed UX/UI Design

- Real-Time GL for Scalable View of Money Movement

- End-to-End Workflows Improve Back Office Efficiencies

- Card Integration (Real-Time to Processor)

- API- First Architecture for Endless Flexibility and Speed

- User-Centric Functionality

- Compliance/BSA Tools

- Integrated Teller and Member Services Platform

- Document Management and Storage

i-POWER® UI/UX

LATEST ENHANCEMENTS

Intuitive Teller Platform Optimizes Operations and Staff Efficiency

Real Time Access and Automated Communications

Enhanced Data Insights for Efficient Member Services

Advanced Security Automation and Efficient Card Management

Our Core System - Modern Design, Proven Results

We understand the challenges modern community financial institutions face in today’s digital world. Our scalable core banking solution streamlines operations and enhances user experiences to drive growth. Designed with open API layers to make it flexible and easy to scale for current and future needs.

Seamlessly Integrates with your existing systems and applications

Creates meaningful connections with your members

Powerful reporting and analytics tools

Customer-centric tools, to enable credit unions to create personalized experiences

Advanced security and encryption methods

Putting it all Together- Total Solutions

Our Total Solutions seamlessly blend the best of both worlds – the robust foundation of our proprietary and proven core banking system and our flexible digital banking suite. We create a modern banking experience that stands toe-to-toe with the industry’s leading financial institutions from funding and opening a new account, money movement, applying for a loan, and everything in between, powered by a robust marketplace and ecosystem.

OUR GROWING PARTNER ECOSYSTEM

Digital Banking Partners

Core & Digital Banking Partners

Core Banking Partners

Did You Know?

VisiFI is one of the top integrators in our industry

- We have more than 150 API integrations and work with the top 50 partners in Fintech, plus 85+ SSO integrations

TECHNOLOGY AND INFRASTRUCTURE

Safeguard Systems and Data

In today’s environment, where more consumers are using a variety of mobile devices, the challenge of securing data has intensified, particularly with the widespread adoption of BYOD (Bring Your Own Device) practices. The BYOD market is projected to reach USD 587.3 billion by 2030, according to Market Research Future. However, managing security on personally owned devices is complex, making it difficult to maintain full control over data and effectively mitigate the risk of breaches.

To address these challenges, VisiFI ensures that our hybrid apps do not store any data locally; all data is kept exclusively in memory and is available only for a short period of time. Additionally, we enhance security by restricting system access not only to the user, password, and token but also by linking it to a specific device and verifying that it originates from the authorized app.

Our hybrid approach also creates a private and secure connection, regardless of the technology used by the endpoint devices. This ensures that sensitive information remains protected at all times.

Maximum Efficiency and Streamlined Updates

We can instantly automate release changes for all financial institutions, with minimal to no involvement from the financial institution or the end user. For the user, the update occurs instantly and completely transparently. This not only increases efficiency but also ensures 100% that the end user is always using the latest verified and certified version.

In contrast, traditional native applications only require each instance to be managed independently, which can be burdensome.

For example, each financial institution would need to manually update their app following every release. VisiFI conducts four major digital banking releases annually, along with an estimated eight minor releases. Without a hybrid application it would necessitate significant resource allocation from both the financial institution and VisiFI to manage and track these updates across all platforms.

Enhanced Experience and Seamless Authentication

The landscape of banking has evolved, with many members now integrating their Digital Banking applications with a variety of financial fintech apps via platforms like Plaid. This integration expands the capabilities of a financial institution’s Digital Banking app within seconds.

VisiFI’s use of hybrid development simplifies the secure and rapid implementation of single sign-on (SSO) and authentication processes, ensuring a consistent and seamless user experience across all linked services.

Utilizing Data for Strategic Growth

Data is a critical asset for financial institutions, providing valuable insights and support to members. While hybrid enhances security, it also contributes to growth by offering a framework for tracking and analyzing data. The technology not only accelerates data transmission, but also facilitates the monitoring and auditing of app usage and data access. These capabilities help identify potential security threats, prevent fraud, and support informed decision-making within financial institutions.

Our hybrid app approach provides the best of both worlds and enables each financial institution to have a branded native app in app stores. The apps are customized with brand-specific colors and images and leverage the strengths of both native and web-based technologies. This provides a cost-effective, secure, efficient, and scalable solution that meets the needs of the modern consumer and our digitally savvy financial institutions looking to grow and provide personalized service.

VisiFI’s full complement of security applications allows our customers the flexibility to design their own level of protection while also balancing the convenience for the online user. Our security protocols are embedded into our solutions which ensures the online activity is protected regardless of the core system or other technology integrations. to protect both our customers and their account holders.

From accessing the account, to managing data within it, to moving money, to protecting the entire experience from external attacks; our security applications feature the highest and most recognized security functionalities within the industry.

Industry Events

The VisiFI team actively participates in industry events, and customer engagement sharing expertise on best practices and commitment to thought leadership and collaboration within the credit union industry.

INDUSTRY INSIGHTS

Catch our most recent news, inside perspective, and insights from our VisiFI experts, customers and leaders across the space on important industry topics.

Session Highlights

- VisiFI Product Evolution – Co-Creating the Future for Growth

- Experience is Everything

- Strategic Member Engagement: A New Era of Value Creation

- So Many Scams – So Little Time

- Advocacy and Regulatory Landscape – Ask the Auditor

- Roadmap Session: Core Banking and Ancillary Solutions

- Roadmap Session: Digital Banking, Ancillary Solutions

- Leveraging AI for Personalized Member Experience

- Data as a Growth Driver

- Next Gen Technology and Digital Transformation

- Putting it all Together to Drive Growth