Core Banking

Open and Adaptable. Everything you Need and More.

A Proven Full Service Core Banking System

We offer a comprehensive and scalable solution designed to simplify core banking, streamline operations, enhance personalized experiences, and drive growth.

We balance openness and control to create a flexible and secure software environment for your staff and users. Our dynamic network of best-in-class partners offers a true seamless experience with top-tier features from industry leaders enabling efficient access to core functionalities, that can meet current and future needs.

Say goodbye to disruptions and complexities during implementation- our team is dedicated to helping you transform your entire core banking journey for every branch, every channel, and every account holder.

Key Features

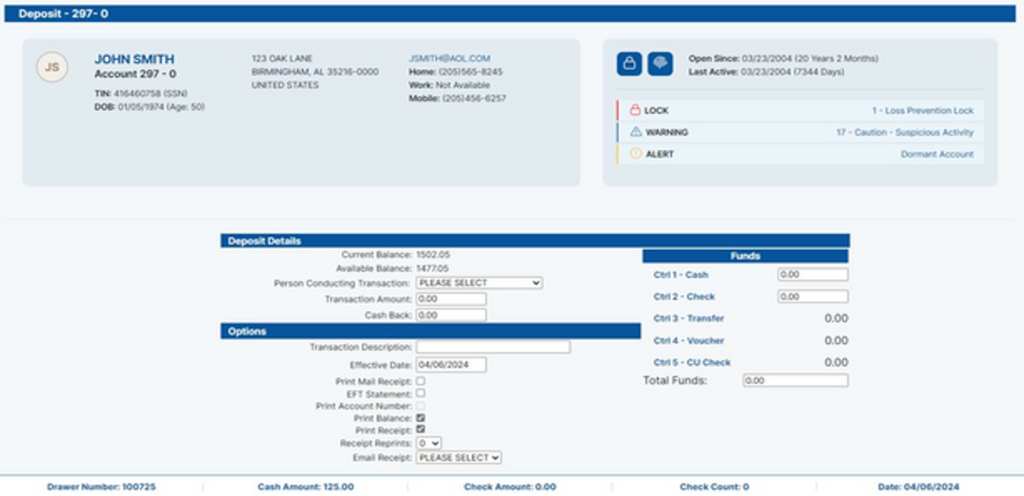

- Integrated Collections and Payments System

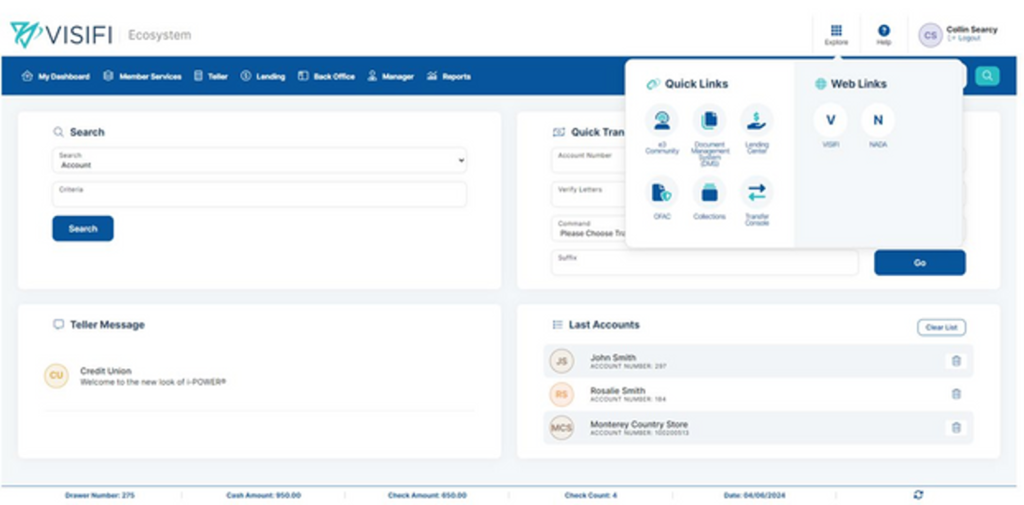

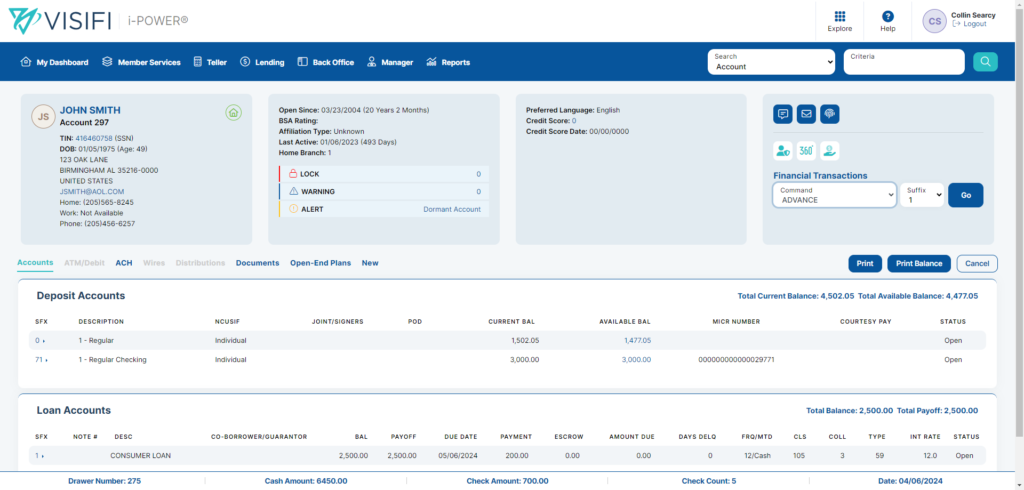

- Behavioral Science-Backed UX/UI Design

- Real-Time GL for Scalable View of Money Movement

- End-to-End Workflows Improve Back Office Efficiencies

- Card Integration (Real-Time to Processor)

- API- First Architecture for Endless Flexibility and Speed

- User-Centric Functionality

- Compliance/BSA Tools

- Integrated Teller and Member Services Platform

- Document Management and Storage

Why VisiFI Core Banking:

Comprehensive Financial Ecosystem

With easy-to-use features, our core banking system simplifies complex operations, reduces clicks, and automates time-consuming routine tasks, while enhancing and personalizing member experiences. Many customers converting from other systems have reported significant improvements in operations, including real-time visibility/access, optimized efficiency, automation, and enhanced services.

Flexible and Scalable

Highly adaptable solution that can grow with your institution. Whether you’re a small credit union or a community bank, it can be tailored to meet your specific needs.

Seamless Integration

Our core banking solution seamlessly integrates with your existing systems and applications, minimizing disruptions and simplifying the implementation process.

Behavioral Science Based UI/UX

Our solution helps your financial institution create personalized, engaging experiences for customers across all channels. Our intuitive navigation, backed by behavioral science, simplifies operations and minimizes training time.

Comprehensive Reporting

Gain valuable insights into 360 degree user behavior, transaction trends, and performance metrics with our powerful reporting and analytics tools.

Regulatory Compliance

Stay ahead of regulatory changes and industry standards with our built-in compliance features like – BSA, AML, and KYC

Optimize Efficiency

Streamline operations, reduce manual tasks, and enhance efficiency to strategically focus on key business activities.

Security and Fraud Prevention

Advanced security and encryption methods safeguard devices, systems, and data to protect from fraud and cyber threats 24/7.

24/7 Support

Our dedicated support team is available around the clock to assist with any issues or questions you may have, ensuring uninterrupted service for your members.