Modular. Open. Connected.

Banking Solutions Built for Growth.

Helping credit unions and community banks accelerate efficiencies, and deliver personalized digital services.

Modular. Open. Connected.

Banking Solutions Built for Growth.

Helping credit unions and community banks accelerate efficiencies, and deliver personalized digital services.

Your Voice. Your Vision. Your Values.

Customer-Focused Digital Innovation that Delivers Results

We put customers at the center of everything we do to bring their vision to life. From providing behavioral science-backed design that unlocks growth to developing and integrating tailored solutions that meet the highest compliance and security standards, we ensure your voice is heard every step of the way.

Customer-Centric Mission

Being a trusted partner who listens and understands is our mission. We prioritize customers at every level to ensure service excellence.

World-Class Ecosystem

With hundreds of integrations, our dynamic network of best-in-class partners offers a true seamless experience with top-tier functionality.

Joint Innovation

Joint development initiatives shaped by our customer-led community forums and innovation labs help connect new ideas and drive tangible growth.

Customer-Centric Mission

Being a trusted partner who listens and understands is our mission. We prioritize customers at every level to ensure service excellence.

World-Class Ecosystem

With hundreds of integrations, our dynamic network of best-in-class partners offers a true seamless experience with top-tier functionality.

Joint Innovation

Joint development initiatives shaped by our customer-led community forums and innovation labs help connect new ideas and drive tangible growth.

Connected Solutions. Flexible and Secure Experiences.

Our API-first development and integration approach provides flexible and scalable solutions needed to compete and grow. From core to digital banking, account opening, digital lending, and everything in between, we create connected and secure experiences protected by industry best practices in data and systems security.

Core Banking

Our user-friendly and adaptable core banking system provides modern, open front-end and back-end with real-time processing to dramatically improve efficiencies and accelerate growth.

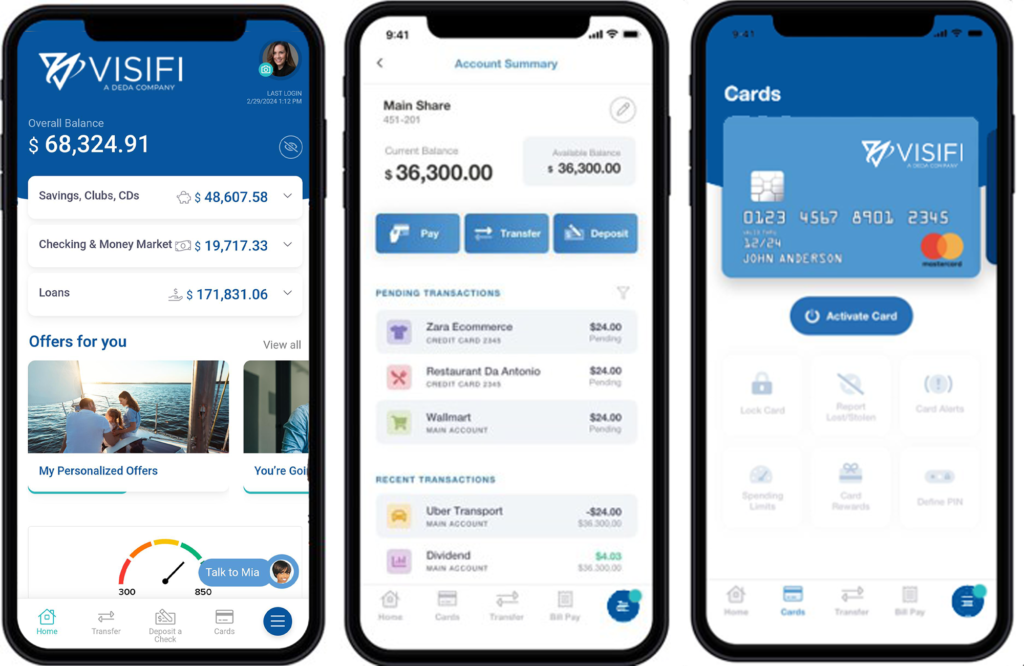

Digital Banking

Open and flexible digital banking integrates with our core or others for added options and a best-in-class ecosystem to create endless choices with features account holders expect, all backed by behavioral science.

Total Solutions

Total Solutions seamlessly connects our core banking and digital banking to create an end-to-end personalized experience from funding and opening a new account, money movement, applying for a loan, and everything in between, powered by a robust marketplace and ecosystem.

Award-Winning Digital Solutions Built to Accelerate Growth and Enhance Operations

Drive loans, grow deposits, retain account holders, and improve productivity. Sound good?

72% Reduction in Call Center Volume

64% Increase in New Mobile Users

47% Increase in New Account Opening

Personalized. Modern Digital Experiences.

Our Company Story

We are part of the global technology company, Deda, specializing in strategic financial service solutions that foster sustainable growth through digital innovation.

Our team members have decades of banking and financial services experience, including former tellers, loan officers, branch managers, operations managers, COOs, and even CEOs. We get you!

Join the Conversation!

We believe in actively engaging our customers in shaping our product development strategies to ensure the highest standards of service excellence. We continually evolve our approach to meet the changing expectations of our customers and their business requirements by utilizing insights from both our internal market experts and third-party collaborations. Ready to join our community?

FOLLOW US ON SOCIAL MEDIA