Unlocking Growth and Member Engagement: The Crucial Role of Data Analytics

In the dynamic and rapidly changing digital era, credit unions are finding themselves in a highly competitive financial landscape. To thrive and grow in such an environment, they must harness the power of data analytics. VisiFI, with its focus on helping credit unions succeed, recognizes the significance of data analytics in enabling these organizations to unlock new opportunities, enhance member engagement, and stay ahead of the curve. In this blog post, we will explore why data analytics is crucial for credit unions and how it empowers them to thrive in today’s ever-evolving financial industry.

Empowering Personalized Experiences

Data analytics solutions provide credit unions with a unified view of member data, encompassing member activity, lending, card service, digital banking, and more. This consolidated data helps credit unions understand their members on a deeper level, enabling them to offer personalized experiences. Today’s consumers expect tailored services, and data analytics is the key to meeting these expectations and building lasting member relationships.

Insights for Innovations and Growth

Data analytics offers valuable insights into members’ behaviors, preferences, and needs. Armed with this knowledge, credit unions can identify new opportunities for innovation and growth. By developing products and services that align with member demands, like the VisiFI Digital Solutions, credit unions can foster higher member satisfaction and loyalty, ultimately driving growth.

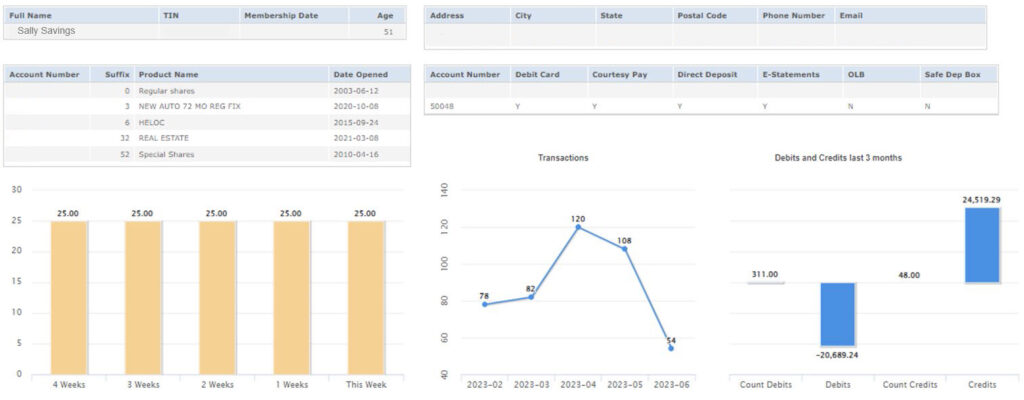

The Power of the 360 View

The member’s 360 View acts as a comprehensive repository of member data and interactions. This powerful tool enables credit unions to make informed decisions across all levels of the organization, from front-line staff offering personalized recommendations to branch managers analyzing performance metrics, and executive leadership tracking product effectiveness, the 360 View is a catalyst for data-driven decision-making.

The Member Experience

Members are looking to engage with financial institutions that can eliminate or minimize the friction created by tools or experiences that are not intuitive, easy to use or provide convenience to their daily lives.

Having a credit union with tools that allow the service providers immediate access to critical member data or the ability to retain the details on member requests and timely follow-up can help enhance the member experience. A bad experience will drive the member to look elsewhere for services.

Then capturing these engagement and data points further provide analytics and trends to measure the performance of the services and member behaviors.

Gaining Efficiency and Actionable Insights

Some examples of how data analytics offers credit unions a multitude of efficiencies and actionable insights:

- Streamlining member engagement processes, reducing response times, and improving service quality.

- Centralizing data sources, ensuring seamless access to comprehensive member information

- Elevating member experiences by delivering personalized, relevant services.

- Measuring performance through intuitive dashboards and KPI tracking

- Anticipating member life events and providing timely support and guidance

- Understand member “out-of-wallet” behavior to meet evolving needs proactively

Value Propositions

Data analytics has emerged as a pivotal force driving credit unions toward growth, member engagement, and sustainable success. By embracing data-driven decision-making, credit unions can optimize operations, enhance member experiences, and remain competitive in the dynamic financial landscape. In an era where data reigns supreme, data analytics is no longer just a tool but a strategic imperative for credit unions determined to thrive and make a lasting impact on their members’ financial journey.

Share this post: