The Cost of Doing Nothing Is Now: Why Staying on a Legacy Core Is the Most Expensive Decision You Can Make

How are you ensuring your credit union continues to grow and isn’t falling behind in delivering value to your members?

For many credit unions still operating on legacy core systems, the decision to “wait and see” feels safe. But that safety can be an illusion and a costly one.

The cost of doing nothing isn’t coming. It’s already here.

You’re not just paying for what your system does. You’re paying every day for what it can’t do.

Credit unions that are staying competitive balance risk with rewards by accelerating their digital transformation, modernizing core systems, expanding digital banking capabilities, and leveraging data-driven insights to personalize member experiences. In other words, every day you stay on outdated systems, you stop investing in your members and staff.

Operational Risk: Hidden Costs That Add Up Fast

Your legacy core may keep the lights on, but it’s dimming your operational efficiency and costing you more than you think:

- Slow problem resolution = 10–12 staff hours per month lost

→ That’s $15K–$25K per year in wasted productivity.

- Limited third-party integration means custom workarounds

→ Driving 20–30% higher integration costs over 3 years.

- No roadmap transparency = delayed response to regulatory updates and increased compliance risk.

Every inefficient workflow is time your team can’t spend serving members, innovating, or growing your business.

Member Experience: A Digital Experience They’ll Leave You Over

Modern members expect intuitive, seamless digital banking. When your tech can’t deliver, they don’t wait around:

- Outdated mobile UX causes 2–3% annual member attrition

→ For a credit union with 20,000 members, that’s 400–600 lost members per year

→ That’s $150K–$250K per year in lost revenue from fees, loans, and interchange.

- Poor app ratings + digital fatigue = missed opportunities to attract younger generations.

- Fintech and BaaS providers are raising the bar—can your legacy systems keep you agile enough to meet modern expectations?

The longer your platform lags, the wider the gap becomes between your brand and your members’ needs.

Strategic Risk: Inaction Limits Growth

Legacy cores don’t just slow you down, they block your future:

- Lack of flexibility deters fintech partnerships, innovation initiatives, and merger opportunities.

- Staff frustration from using outdated tools increases turnover

→ Costing $50K+ annually in recruitment and retraining

Missed opportunities for real-time innovation mean you’re always playing catch-up.

You may think you’re holding steady, but in the eyes of your competitors and potential partners, you look like you’ve stalled.

What It Costs to Get It Wrong

Sometimes the costliest move is not making one at all. If you end up re-implementing in 2–3 years after realizing your current system can’t keep up, here’s what you’re looking at:

Direct Costs

- Re-implementation Costs: $500K–$700K

- Early Termination Penalties: Up to $200K

- Add-on Spending for Missing Features: $100K–$250K/year

Indirect Costs

- Productivity Drag: $50K–$100K/year due to outdated workflows

- Member Loss + Brand Damage: Reduced NPS, lower retention, shrinking lifetime value

- Opportunity Cost: Missed product launches, delayed marketing campaigns, and lack of competitive edge

→ Over $1M in lost growth potential over just 3 years

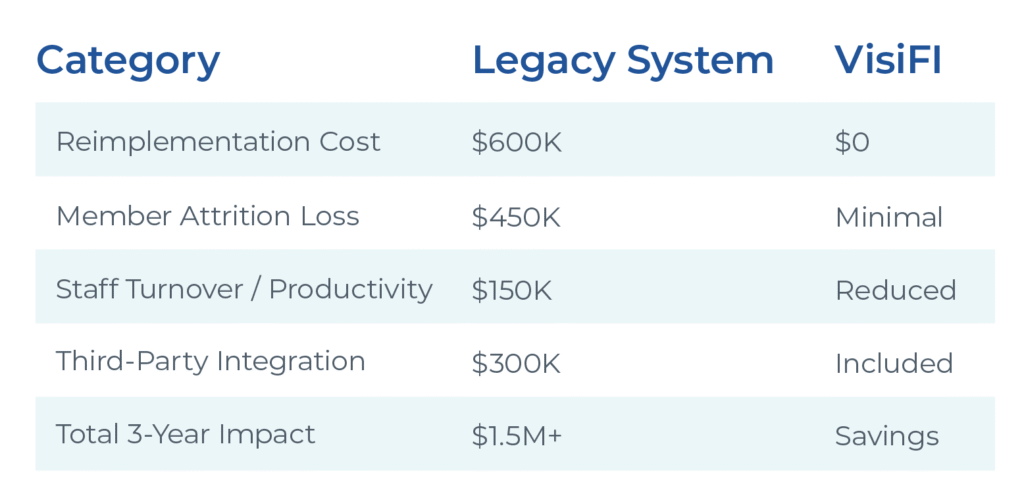

3-Year Financial Comparison Estimate: Legacy System vs. VisiFI

VisiFI offers more than a modern platform, we deliver flexibility, speed, and partnership designed specifically for credit unions ready to grow.

The Bottom Line

If you’re still running your institution on a legacy system, the real risk isn’t the cost of converting—it’s the compounding cost of staying put.

Every day you delay:

- You lose productivity

- You fall behind digitally

- You risk member relationships

- You forfeit future opportunities

The most expensive strategy in 2025?

Doing nothing.

It’s time to stop paying for limitations and start investing in possibilities.

Let’s talk about how VisiFI can help you move forward without looking back. Connect with us at info@visifi.com.

Share this post: