Public Service Credit Union and VisiFI: One Year Later

Public Service Credit Union and VisiFI

About Public Service Credit Union

Public Service Credit Union is proud of its roots, serving as the credit union to the hard-working employees of Wayne County.

Over time, PSCU was able to expand their branch network to multiple counties in southeast Michigan and is now able to provide membership to anyone who lives, works, attends school or worships in the state of Michigan. Along with a growing physical presence, PSCU has also provided members (and non-members) with vast digital options so that they have 24/7 access to their money no matter where they are.

Public Service Credit Union hopes to continue providing and protecting their member’s finances with improved services and new innovations.

Public Service’s Key Figures

33,000

Members across

the US

20

Diverse

Digital Touchpoints

10

Shared

Branching Locations

The Context

Members Actively Using Digital Bundle

One of the goals of Public Service Credit Union (PSCU) was to improve their suite of digital products while maintaining a high-level member experience. They wanted to increase member loyalty and bring loans and deposits back to the credit union. They realized their members were using fintech apps to apply for loans and do their banking, but the members didn’t realize PSCU offered these same services. PSCU needed to spread the word and to have a digital branch that spoke the language of the member.

During the 4th quarter of 2020, PSCU created a new division called Member Experience. They had already seen a drastic increase in their digital channels volume but knew they needed to make these tools easy to use to get more members onboard and strengthen their loyalty. They also began researching top Digital Providers and chose VisiFI to partner with in developing the platform. VisiFI brought in Common Cents Lab to help them understand the Behavioral Science behind the digital banking behavior which VisiFI and PSCU then incorporated into the product.

In August 2021, the credit union and VisiFI went live with the new Digital Bundle.

“This digital department has been instrumental in allowing us to really focus on improving the member experience and build our digital suite of products. Knowing that there is support from our executive team and Visifi to grow in this area has been crucial in keeping us competitive and ahead of the curve. We are really having fun exploring the endless things we can do when we partner and collaborate with some of the amazing FinTech’s. I look forward to seeing how it translates into the member experience.

A strategic goal of ours has always been to improve our suite of digital products. We were grappling with how to build the experiences our members want in a world that is increasingly digital, particularly since the onset of the COVID-19 pandemic. We knew that we couldn’t just roll out products, but we needed a department dedicated to improving the digital member experience and guide our wide range of membership to successfully utilize those tools.

As more and more of our members adopt digital tools to access their accounts and engage with us, we are devoting more resources to optimizing the experiences in those channels and making financial tools more accessible and easier to understand.”

– Dean Trudeau, President/CEO Public Service Credit Union

The Solution

The results were even better than expected!

PSCU has seen consistent growth of the new digital products since August 2021. Along with the increase in usage of the individual products shown below, they saw a 62% increase in mobile banking logins and a 44% increase in mobile banking loyalty – members logging in monthly to manage their accounts.

Active Mobile Users – 42% increase year over year

Active Online Users – 15% increase year over year

Remote Deposit Capture – grew 27% over 12 months. Members used it more frequently now that it is a seamless member experience.

Card Management – 91% of members used it within the first year.

Person-to-Person – After the digital banking upgrade PSCU saw a 40% lift.

“This digital department has been instrumental in allowing us to really focus on improving the member experience and build our digital suite of products. Knowing that there is support from our executive team and Visifi to grow in this area has been crucial in keeping us competitive and ahead of the curve. We are really having fun exploring the endless things we can do when we partner and collaborate with some of the amazing FinTech’s. I look forward to seeing how it translates into the member experience.”

– Nadine Hohnke, Digital Member Experience Manager

Campaigns and Continuous Momentum

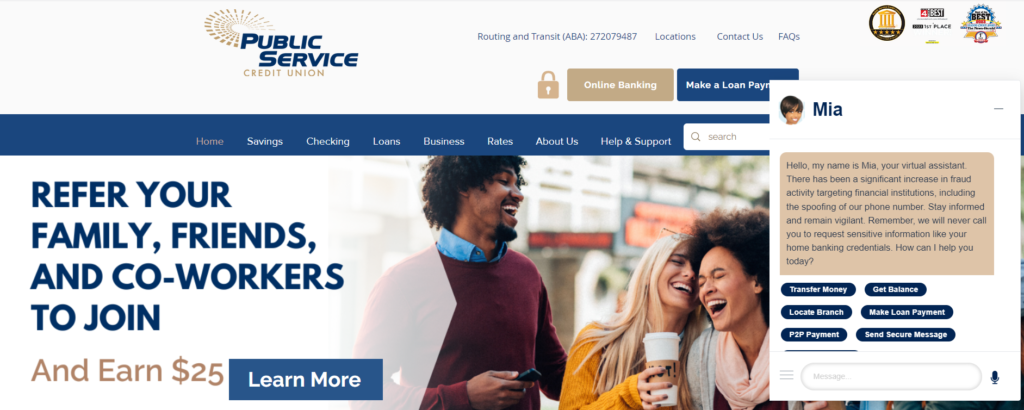

Introducing Mia (My Intelligent Assistant)

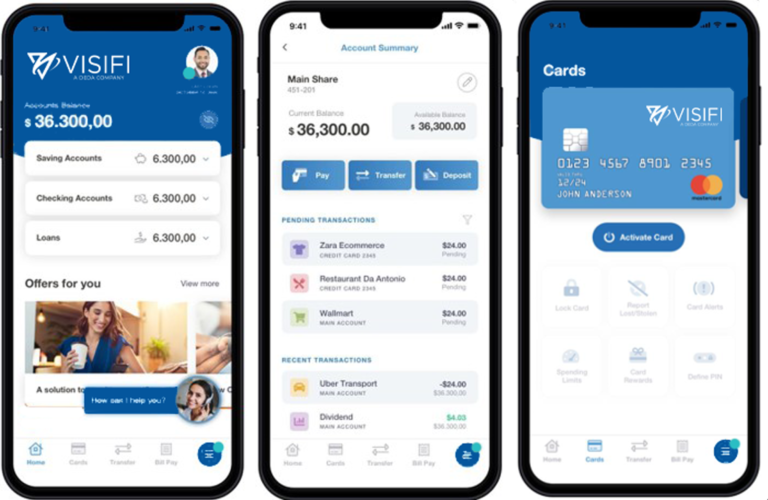

Mia is an enterprise conversational AI chatbot that travels from your website to your online and mobile banking application to your smart home/car with Alexa, GoogleHome or Siri.

Adding Mia to the PSCU website caused mobile banking users to spike 33%. Mia is driving members to use digital and the frequency of usage has continued to grow for these members. It has also decreased the call volume for customer service from 8,000 – 10,000 calls per month to 6,000 – 7,000 calls per month. 72% of the call volume is repetitive and 31.59% of the questions were asked outside of business hours. The Top 3 Questions are branch location/hours, get transactions and pay my loan. Mia has handled these types of questions with a 99% Intent Success Ratio. In the future they plan to use Mia to cross-sell and educate their members.

Security of Card Management

With the increased # of members managing their cards through the digital channel, PSCU has seen 5,500 members actively freeze their debit card to protect themselves from fraud. This is exciting security behavior and they believe it has resulted in fewer fraud disputes.

Updates

2023: Drive loans & deposits while providing financial wellness education. VisiFI partnered with SavvyMoney to integrate their solution within Digital Banking.

2023: Marketing CRM that integrates with VisiFI’s i-POWER core that provides data segmentation, cross-sell and lifestage marketing campaigns. VisiFI partnered with Marquis and integrated within both the core and digital banking.

2024: Self-Service and Access- Travel Alerts through Card Management App and Digital Card Issuance with Coop.

In Process.